south dakota property tax rates by county

The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. Then the property is equalized to 85 for property tax purposes.

Property Taxes By State In 2022 A Complete Rundown

Real Estate Taxes - Pennington County South Dakota Home County Info Public Info Real Estate Taxes Pay Property Taxes Real estate taxes are paid one year in arrears.

. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. Stanley County collects on average 109 of a propertys assessed.

State Summary Tax Assessors South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Start Your Homeowner Search Today. For instance if your home has a full and true value of 250000 the taxable value will add up to 250000.

All property is to be assessed at full and true value. Ad Find The South Dakota Property Tax Records You Need In Minutes. Redemption from Tax Sales.

Then the property is equalized to 85 for property tax purposes. Taxation of properties must. The median property tax in Stanley County South Dakota is 1244 per year for a home worth the median value of 113700.

Your 2021 Tax Bracket To See Whats Been Adjusted. Sully County collects on average 107 of a propertys assessed fair. Get Accurate South Dakota Records.

The median property tax in Sully County South Dakota is 772 per year for a home worth the median value of 72200. Such As Deeds Liens Property Tax More. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

If the county is at 100 of full and true value then the equalization. Ad Compare Your 2022 Tax Bracket vs. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest.

Search Valuable Data On A Property. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. See Whats Been Adjusted For Income Tax Brackets In 2022 vs.

Lincoln County has the highest property tax rate in the state at 136. The median property tax also known as real estate tax in Custer County is 155400 per year based on a median home value of 16070000 and a median. South Dakota Property Tax Rates.

Ad Get In-Depth Property Tax Data In Minutes. Custer County South Dakota. You can look up your recent.

Roberts County South Dakota. Median property tax is 162000 This interactive table ranks South Dakotas counties by median. The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

The states laws must be adhered to in the citys handling of taxation. Visit Our Website For Records You Can Trust. This is the value upon which your South Dakota property taxes are based.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. The median property tax also known as real estate tax in Roberts County is based on a median home value of and a median effective property tax rate of 146. South Dakota Property Taxes by County South Carolina Tennessee South Dakota.

North Dakota Officials Propose Flat Income Tax Rate Eliminating Individual Income Taxes For Most Taxpayers Inforum Fargo Moorhead And West Fargo News Weather And Sports

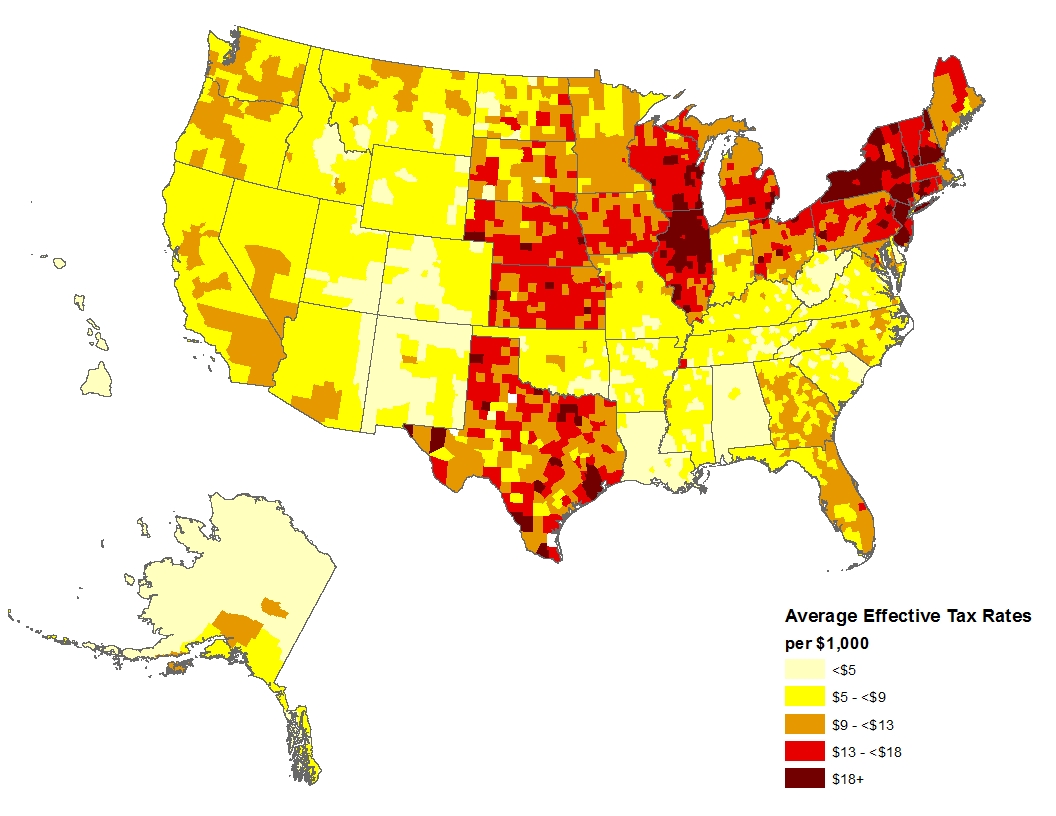

Property Taxes By County Interactive Map Tax Foundation

How Property Tax Rates Vary Across And Within Counties Eye On Housing

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Tax Information In Tea South Dakota City Of Tea

Property Taxes By State Highest To Lowest Rocket Mortgage

Property Tax Comparison By State For Cross State Businesses

Property Tax South Dakota Department Of Revenue

South Dakota Income Tax Calculator Smartasset

South Dakota Sales Tax Small Business Guide Truic

Understanding Your Property Tax Statement Cass County Nd

Thinking About Moving These States Have The Lowest Property Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MZGZ4UOS3ZA3TI4YXXFO3WKABU.png)

Dakota County Assessor S Office To Reissue Tax Rate Postcards

Comparing Average Property Taxes For All 50 States And D C

Democratic Senator Suggests Property Tax Relief Plan For North Dakota Taxpayers Inforum Fargo Moorhead And West Fargo News Weather And Sports

General Sales Taxes And Gross Receipts Taxes Urban Institute

Property Taxes How Much Are They In Different States Across The Us